1. INTRODUCTION

Markets of digital information are very special. If one sells a piece of information, the customer will get the information, of course; however, the seller still owns it, too, as the buyer only received a copy. One may observe special market mechanisms on information markets in contrast to tradition non-digital goods, namely there are dominant fixed costs for the first data set (and low costs for all copies); we see distinct information asymmetries (between informed service companies and much less informed customers); there are pronounced direct and indirect network effects (leading to the winner-takes-it-all phenomenon); and, finally, there is a tendency towards mutating every piece of digital information into a public good (due to simply made copies) (Linde & Stock, 2011). All these regularities are well known in information science and in economics.

In this article, we theoretically and terminologically analyze the different kinds of payments on information markets, which are also very special. The sellers of digital information make their claims, partly open (asking for money), partly hidden, and without even asking (taking customers’ data or their attention as payment). Lanier (2014) calls the latter companies “siren servers,” which delude their customers into thinking that their services are free. Obviously, there are different market sides concerning kinds of payment.

As this is also a broadly known fact, what is new in this article? We will describe and analyze the payment structures of information markets. Will payment with attention and personal data be a new currency? Such a currency has consequences for the selling and purchasing behavior of companies and of customers, as well as for legal rules. Both competition law (in the United States [US]: anti-trust law) as well as data protection law have to be modified in regard to personal data economics and attention economics.

2. INFORMATION MARKETS

On information markets, information goods are traded: “An information good is everything that is or can be available in digital form, and which is regarded as useful by economic agents” (Linde & Stock, 2011, p. 24). Information goods are both products and services; main product groups are software and content, including products of publishing houses (articles, books, and proceedings), search services, digital libraries, and social media. Information markets exhibit network effects, namely direct network effects (the more users a network attracts, the more its value―the more a network is worth, the more it attracts new users) and indirect network effects (the greater the network, the more complementary offers―the more complementary products and services, the greater the network’s value). If there is no primary and complementary good, but both goods are of equal importance, we speak of “two-sided indirect network effects” (Linde & Stock, 2011, p. 60). A classic example is the interplay of an operating system (e.g., Android) and application software (e.g., Office on Android). An operating system without applications is useless, and an application without an operating system cannot run. Markets with two-sided indirect network effects are called “platforms”; they are “two-sided markets” (Rochet & Tirole, 2003, 2006), or―in the general case―n-sided markets and multi-sided platforms (Evans & Schmalensee, 2016; McAfee & Brynjolfsson, 2017). Multisided platforms “connect two or more independent user groups, by playing an intermediation or a matchmaking role” (Abdelkafi, Raasch, Roth, & Srinivasan, 2019, p. 553).

Besides two- (or n-) sided indirect network effects, there is a second phenomenon on platforms with two or more closely connected player groups on the same market―distinguished by the kind of payment. On information markets, there are two kinds of currencies beyond money:

Since the time of commercial TV, there is an “attention economy,” as the TV companies sell their viewers’ attention to advertising firms during commercial breaks. Davenport and Beck, in their book The Attention Economy (2001), clearly state, “in TV, viewer attention is exchanged for money” (p. 9). On digital information markets, for instance, the search engine company Google sells users’ search arguments to advertisers leading to context-specific online advertising in hopes of the users’ attention for the displayed ads (Ruhrberg, Kirstein, & Baran, 2017). In the “personal data economy” (Elvy, 2017), data on and of the users are sold to advertisers, which is the business model of many social media companies including Facebook Inc., also called personalized online advertising.

3. ARITY

As the designation “two-” or “n-sided” markets is occupied by the players of indirect network effects, we introduce “arity” for the denotation of information markets with different market relations concerning the kind of payment. An n-ary relation is “a set of homotypic elementary n-tuples” (Kulik & Fridman, 2018, p. 95), while a “tuple” is “a sequence of some objects” (Kulik & Fridman, 2018, p. 98). n counts the number of concrete object types (sometimes called “arguments,” too), which form the specific relation. There are nullary relations (0 argument), unary relations (1 argument), binary relations (2 arguments), ternary relations (3 arguments), and for describing a general case n-ary relations (n arguments). Unary relations are also called “monadic,” and binary relations “dyadic.” The concept of “arity” is used in formal logic, mathematics, computer science, and information science.

We will illustrate arity with the help of two examples from information science. In Boolean retrieval, we distinguish between monadic and dyadic operators. A monadic operator (such as “not:” ~A) has exactly one argument (here, A); dyadic operators (such as “and” in A and B, or “or” in A or B) have two arguments (namely, A and B). Knowledge organization works with concepts and relations, for instance, in thesauri and classification systems. The general case in knowledge organization systems considers dyadic relations connecting two concepts, e.g., hierarchy: “A is a broader term of B,” while A and B are concepts. However, there are also ternary relations between concepts; for instance, healing is a ternary relation between a person, a disease, and a medication.

A nullary market is impossible as there would be only one market side, but no market at all. A unary market is typical for non-information markets beyond the Internet. One market side (the seller) provides a product or a service, and on the other market side (the buyer), if she or he is willing to buy, the buyer pays for it with money (or sometimes with barter). A binary market has two exchange relationships. One market side provides a product or service and the other side pays with data or attention, but not with money. This market relation can be understood as a special form of barter trade. In turn, the seller provides the users’ data or their attention to advertisers, who are now paying with money. A ternary market consists of three different relationships, and―in the general case―an n-ary market of n relationships.

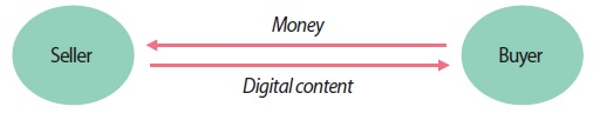

4. UNARY INFORMATION MARKETS

In times before the Internet became popular, unary information markets were the standard case (Fig. 1). The development of relationships between sellers and buyers is essential for all markets (Dwyer, Schurr, & Oh, 1987): in the direction of seller–buyer, goods become offered and sold; in the direction of buyer–seller, money flows after a completed purchase. Information suppliers, for instance DIALOG or LexisNexis, have sold records of their information services since the early 1970s to libraries or companies, and their customers paid with money. On some content markets of the contemporary Internet, we can still identify such unary markets. In the academic information landscape, we find services like Web of Science, Scopus, or publishing houses (e.g., Elsevier, Springer, and Wiley) selling their databases as well as journals, and their customers pay with money. The same do users of Netflix or Amazon Prime while watching movies or serials of streamed videos. Nowadays, the prevalent kind of payment for content is the subscription model. Also many hardware and software companies prefer to use unary information markets. So, users pay with money when they buy products such as Fitbit (activity trackers), Microsoft Office, or IBM SPSS.

5. BINARY INFORMATION MARKETS

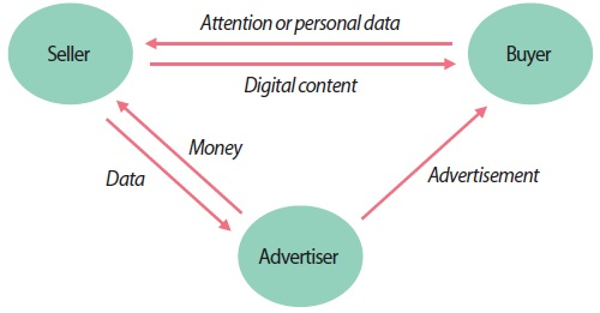

In our model (Fig. 2), a “seller” is an Internet company which supplies digital content, for instance Google or Facebook. The “buyer” of this digital content is a user of the seller’s content and at the same time a potential customer of any company which undertakes marketing on digital media. The “advertiser” is such a company or its media agency presenting the “right” advertising message to the “right” potential buyer.

Binary information market: A seller, e.g., Google or Facebook, supplies digital content to a buyer; in return, the buyer pays with his or her personal data or attention (exchange relationship no. 1). The same seller supplies the user’s personal data or his or her attention to an advertiser; in return the advertiser pays with money. Finally, the advertiser presents the advertisement to the buyer of digital content (exchange relationship no. 2).

On a binary information market, every market side is included in two relations. A buyer of digital content gets content from the seller and pays with data; the seller provides its service without monetary costs to the buyers and sells their data to an advertiser, who in turn pays with money; finally, the advertiser buys the data from the seller and displays the ad (via the seller’s platform) to the buyer. Players on binary markets must “get both sides of the market on board” (Rochet & Tirole, 2003, p. 990). For Google and Facebook, the two market sides are the buyers (or users or customers) on the one hand and the advertising companies on the other.

The search engine Google is a typical example for a binary information market. A customer places a search argument on Google, and Google searches twofold, on the one hand in its repository of stored web pages presenting the “objective” results to the user, on the other hand in its repository of keywords (in the Google Ads service) presenting the found ads to the user in a special section of the search engine results pages. On the platform of Google Ads, the advertisers book a keyword and bid a maximal price for a Vickrey auction (a second price auction). This bid price, together with quality measures of the advertiser’s keyword and the landing page, determines the ranking of the ads which are presented to the user, and also the price the advertiser has to pay (Linde & Stock, 2011, pp. 335-339). The kind of data which the users have to pay in this example of Web search engines is their search argument and their attention when seeing the ads and clicking on them.

The payment for the smartphone operating system Android is a good example from the software industry. Without any monetary costs for users, on many smartphones this system is pre-installed. In the Google activity log Android tracks, among other data, phone numbers, calling-party numbers, time and date of calls, duration of calls, opened apps, visited web sites, and voice commands on the phone and sends these data periodically to Google. So the users pay with such data. In contrast to the paid data while using search engines, here the users do not explicitly know what data are used for payment.

Other good examples of a binary information market are social media services as, for instance, Facebook. Such services collect detailed person-related data in an amount which is dependent on users’ willingness to provide information in their profiles and, additionally, on users’ digital traces, which comprise their posts (texts, images, or videos), their “friends,” viewed posts, the frequency of viewing these posts, and their reactions on posts (likes, shares, and comments). Using these data, Facebook creates a profile for every user. On the other market side there are Facebook’s advertising customers. For an ad, they have to define their goals (e.g., increasing traffic on their web site), their objectives (awareness, consideration, and conversion, including several subcategories), their budget, and―most important―their audience, which is defined by location, age, gender, languages, interests (e.g., liked Facebook pages), behavior (as, for instance, purchase behavior), and connections (between the concrete user and the advertiser on Facebook) (Curran, Graham, & Temple, 2011). If a user profile and an ad profile match, the ad is displayed to the user. The more information is collected from both market sides, i.e., from customers and from advertisers, the better and the more purposeful is the ad. If a social media company runs more than one service (as Facebook Inc. with the social networking service Facebook, the image sharing platform Instagram, and the messengers WhatsApp and Facebook Messenger), there would be a clear advantage when the company combines all available data sets on users. The kind of data, which the users have to pay in this example of social media, is their personal data included in their user profiles and derived from their behavior on the social media service.

If a pay-for-privacy model (Elvy, 2017) is realized, a binary information market collapses to a unary market. Here, the buyer does not pay with personal data, but―as is normal on unary markets―with money. An example is the music streaming service Spotify; one can use it for free (with advertising) on a binary information market and one can subscribe to the service (without advertising and with a greater functionality) on a unary market.

6. TERNARY INFORMATION MARKETS

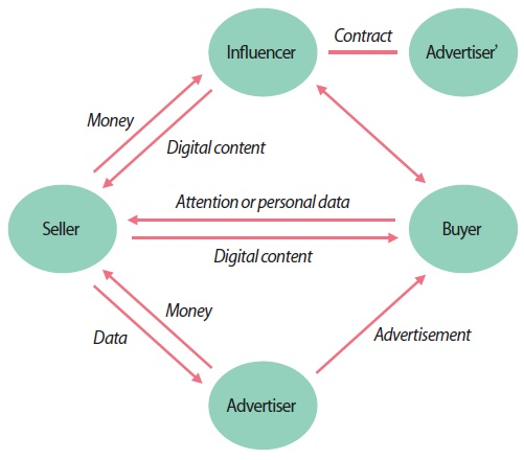

In ternary information markets, a third market side appears. Our example is the new occupational area of influencers in digital media (Fietkiewicz, Dorsch, Scheibe, Zimmer, & Stock, 2018), some of them being “micro-celebrities” (Khamis, Ang, & Welling, 2017; Senft, 2013), sometimes also called “camgirls” and “camboys” (Senft, 2008). For Freberg, Graham, McGaughey, and Freberg (2011, p. 90), influencers are “a new type of independent third party endorser who shape audience attitudes through blogs, tweets, and the use of other social media.” Influencers often realize multi-channel behavior and apply more than one platform, e.g., YouTube, TikTok, or YouNow for the presentation of their videos, and additionally Instagram or Twitter for posting images, text news, or announcements of their (live) videos (Scheibe, Fietkiewicz, & Stock, 2016). Currently, Google’s YouTube, ByteDance’s TikTok, and Facebook’s Instagram are the most used platforms of influencers.

Influencers try to socialize digitally with their fan base; however, there is no “normal” social interaction with bodily contact, proximity, orientation, gesture, facial expression, or eye movement as well as verbal and non-verbal aspects of speech, which is the classical definition of “social interaction” (Argyle, 1969). Instead, the influencer-fan relation is parasocial interaction as the fans do know the influencers via social media channels, but the influencer does not know his or her fans. An audience member, for instance of a TV show, a movie, or of content on social media, sometimes not only passively consumes the content, but he or she builds up a kind of relationship to a “media figure,” namely an actor, presenter, celebrity, or an influencer (Zimmer, Scheibe, & Stock, 2018). The media figure, in our case the influencer, is not aware of all single relationships with the audience; however, the spectators have some knowledge on the media figure. The crucial difference between social interactions and para-social interactions “lies in the lack of effective reciprocity,” establishing an “intimacy at a distance” (Horton & Wohl, 1956, p. 215). The influencer has only knowledge of the number of fans on the applied social media services in terms of the amount of followers as well as of views (and sometime of the number of “likes”) for a single piece of content; she or he tries to foster the fans’ ‘stickiness’ (Chiang & Hsiao, 2015; Zhao et al., 2017) on her or his channels.

The influencer has two sources of monetary income, namely from the seller (which is a social media company) and from a company working together with the influencer in order to distribute their advertising messages. The influencer produces digital content (for instance, a video on YouTube or an image with text on Instagram) and hopes to allocate the attention of the buyers (i.e., the audience). We have to distinguish between actual attention (i.e., the number of views of a single video or an image of the influencer) and expected attention (i.e., the number of the influencer’s followers on the service).

The influencer’s first revenue stream comes from the sellers, which in turn are financed by their advertisers (as in the binary market). The more there is actual attention, the more money the influencer will make. For instance, YouTube pays more than fifty percent of their video-specific AdSense revenues to the influencer, here in sole dependence of the number of views of the video whereby the amount of the fan base and video’s content are irrelevant. Therefore, in this case the buyers pay with their actual attention in terms of watching an influencer’s video (and the embedded ad videos).

The second revenue option for the influencer comes from companies which cooperate with the influencer independently from the platform. The cooperation between an advertising firm and an influencer is usually arranged by a contract; the amount of payment is dependent on the number of the influencer’s followers, i.e., on the followers’ expected attention.

Ternary information market: A seller, e.g., Google with YouTube, YouNow, or ByteDance with TikTok, supplies digital content to a buyer; in return, the buyer pays with his or her personal data or attention (exchange relationship no. 1). The same seller supplies the user’s personal data or his or her attention to an advertiser; in return the advertiser pays with money. Finally, the advertiser presents the advertisement to the buyer of digital content (exchange relationship no. 2). An influencer socializes digitally with buyers, typically via Instagram and YouTube, YouNow, or TikTok, and the buyers watch his or her digital content; in return, the seller pays the influencer with money. Additionally, the influencer may have a contract with an advertiser and sprinkles occasionally paid advertisements in his or her video or image (exchange relationship no. 3).

The additional market side of influencers with their digital content, para-social relations with users, and payments for actual as well as for expected attention constitutes this market as ternary. However, in another view, influencer markets may be considered as binary information markets with the additional service of influencers as distribution intermediaries or sales agents.

7. CONSEQUENCES FOR COMPETITION LAW

In n-ary (n greater than 1) information markets, we find money and attention as well as streams of personal data between the different market sides as currencies. If buyers pay with money, they know the amount of money they have to pay. If they pay with attention or with their personal data, they do not know what they have to pay. It is similar to a business model on a hypothetical unary market where customers are told, “open your wallet and I take what I want―and you do not see how much I took.” For Symons and Bass (2017), there is a need “to reconsider the way personal data is used in the digital economy … giving people back control of their personal data” (p. 7). Privacy is or will be a serious concern on information markets as “privacy changes everything” (Rogers et al., 2019, p. 96).

Contemporary economics and law consider also both money streams, for instance, in competition law (Baran, Fietkiewicz, & Stock, 2015) and consumer protection (e.g., avoiding excessive prices), as well as data streams in data protection law, but they do not consider them together (Fietkiewicz & Lins, 2016). In competition law, important aspects are the concrete demarcation of a market and the position of a company in this market. Goals are the description of a dominant position of the company in the market and the avoidance of misuse of a dominant position. In the binary market of Web search engines, there are flows of money between search engine companies and advertisers and there are flows of data between the end users and the search engine companies, but it is exactly one market. In the ternary market of influencers on social media, there are flows of money between social media companies and influencers as well as the advertisers and there are flows of data (in both directions) between the end users as well as the influencers and (only in one direction) between the end users and the social media companies, but it is again one market.

Additionally, the concentration of data in the hands of one single company has consequences for the control of mergers and acquisitions, which was and still is based upon the company’s revenues (in terms of money). However, there are companies, especially on information markets, with high numbers of users and with a high flow of data, but with only minimal financial revenues (e.g., WhatsApp). An acquisition of such a company (as Facebook’s purchase of WhatsApp) may considerably strengthen the market power of the purchasing firm.

If we want to analyze the market strength of a company on an information market (concerning competition law), we have to consider both the company’s money and the data revenues. A dominant position of a company in a certain market and the determination of its revenues (in case of an acquisition) must be defined, for n-ary information markets (n greater 1), always by the market share in terms of money and in terms of data (Fietkiewicz & Lins, 2016).

8. CONSEQUENCES FOR DATA PROTECTION LAW

If end users pay with their personal data it is not possible to protect all those data by data protection regulations, as there is nothing paid in the end. Of course, buyers might pay with their attention or data instead of their money, so consumers are “data traders” of their own personal data (Crabtree et al., 2016). However, laws should regulate a company’s misuse of money and data streams with the aid of modified data protection laws, which are guided by the fair use of data.

Nowadays, due to new data protection legislation as, for instance, the European Union’s General Data Protection Regulation (GDPR), there are rules requiring sellers to inform users on their general dealings with personal data (found on Terms of Service and Data Protection Declarations of companies in search engine, social media, e-commerce, news, health, or public transport markets). There is no concrete statement of the costs (in terms of data) for a single service or for the subscription of the entire service in question. A customer has to accept such terms and declarations or must leave the service―a phenomenon called the “privacy paradox” (Norberg, Horne, & Horne, 2007). In the end, laws as GDPR are perceived as bureaucratic hurdles, as users have to accept the company’s declarations every time they start to use the service and always click the I Agree button―probably without reading a single word of the terms and declarations. For the majority of users such tracking walls (with the I agree button) are estimated as not fair (Zuiderveen Borgesius, Kruikemeier, Boerman, & Helberger, 2017, p. 357).

What does “fair use” mean (as a term originating in law and ethics; Pressman, 2008) in the context of the attention economy and of the personal data economy? The basic idea is an analogy to unary markets. Here, buyers know (in nearly all cases) the price (in ₩, €, $, ¥, etc.) before purchase. If a buyer pays on 2- or 3-ary information markets with attention or personal data, there should be a price tag telling the buyer the concrete kind of data and its amount―and, for transparency, what the seller makes with these data in order to finance its product or service. This model would be a win-win situation for buyers and sellers: now, buyers know exactly what to pay (in terms of data or attention) and the sellers can clearly show why they need those personal data or attention in order to refinance their activities.

On unary information markets, customers usually pay with money. However, there are markets where users pay with money and maybe additionally with their personal data. An illustrative example is the activity tracking business with products like Fitbit, Garmin, or Apple Watch. The companies store data on their users’ daily steps, heart rate, sleep quality, weight, etc. Of course, they need the data to calculate aggregated information for the users’ benefit (as, for example, a time series of a user’s resting heart rate for months or years). It is open whether the companies handle the data in addition to the necessary calculations, and so privacy concerns may arise (Fietkiewicz & Ilhan, 2020). Fitbit’s audience was somewhat perturbed when Google announced to buy Fitbit. Google’s business was and is heavily driven by data including personal data (as we have seen in our example on binary information markets). What will Google do with these new data? If indeed such health- and activity-related data would be sold to third parties or used for advertising, this would be by no means fair use (European Data Protection Board, 2020).

Personal data gathered, for instance, through cookies or copies of the browser history of the user’s device are also used in some forms of marketing such as real-time advertising (RTA) (Stange & Funk, 2014) or in online behavioral advertising (Varnali, 2019). Besides the advertising companies (or their media agencies), in RTA, new players enter the information markets, e.g., demand side platforms and supply side platforms, both working with cookies and organizing the display of an ad, when an identified user enters a new website. In contrast to the practices by search engine or social media companies, in RTA there is no service for the users by the involved companies, but only gathering of personal data, what clearly is not fair use. Here, larceny of personal data may be present. Nowadays, in these cases, data protection seems not to be regulated at all.

9. CONCLUSION

What are the lessons learnt? On information markets, information goods, i.e., content and software, are traded. Due to two-sided indirect network effects, information services may be platforms and establish two-sided markets. In addition, we observe different market relations between the players on information markets concerning payment. Buyers may pay with money, with their attention, or with their personal data. We called these relations the “arity” of an information market. On unary information markets, there is only one relation between a seller of information goods and its customers. Examples of companies on unary information markets are Elsevier or Netflix; buyers pay with money. Binary information markets are characterized by two market relations for every player. Buyers of digital content or of software get their products and services without a financial contribution, but pay with their attention (e.g., on search engines) or with their personal data (e.g., on social media and some software markets). The sellers provide the users’ attention or their personal data to advertisers, while the latter pay with money. The business model of influencers is more complicated, as it presents activities on a ternary information market, but it is based on the characteristics of binary information markets combined with the influencers’ roles as “media figures” and sales agents.

Binary (and also ternary) information markets call for new regulations concerning competition law and data protection law. In competition law, the concentration of data a company is able to gather on a market should be considered when speaking of a dominant market position or when it comes to regulations concerning control of mergers and acquisitions. This would be an additional criterion beyond the company’s market share in terms of customer counts or of revenues or the buying price in the case of acquisitions.

We do not see problems when buyers pay for information goods with their attention or their personal data, but it should be clear before every purchase what they have to pay in the form of data or attention. Such a fair use rule should supersede the currently practiced behavior of “we take from your data what we want.”

The arity of information markets and its problems concerning the mode of paying and users’ privacy have consequences for information professionals insofar as they work on information markets, e.g. as social media managers or account managers of a search engine. In their daily routine duties, they, for instance, optimize programs for tracking user data or they communicate with customers on the merits of social media and search engine marketing. They should always consider the arity of their markets and the economic, juridical, and―not to forget―ethical issues of paying, be it with money, personal data, or attention. It seems to be the same lesson for information education: Information science programs should include lectures on information markets and their different arity in order to raise awareness of the different kinds of paying, attention economy, personal data economy, competition law, privacy, and data protection law.

This study has a clear limitation. It is a purely theoretical article. We have to study in detail the juridical implications of binary information markets, mainly concerning competition law (in the US, anti-trust law) and data protection law. Albeit law is usually national pertaining to tradition, binary information markets are international and demand basically international law. There is also a lack of empirical data on the acceptance of fair use models on binary information markets. Do end users accept personal data and attention as currency? Are there differences in accepting payment with data and attention by generation? (Perhaps younger people will more likely accept those new forms of payment than older ones.) And are Internet companies like Google or Facebook really willing to install fair pricing models for paying with personal data and attention?

References

, Baran, K. S., Fietkiewicz, K. J., & Stock, W. G. (2015, May 19-21). Monopolies on social network services (SNS) markets and competition law. In F. Pehar, C. Schlögl, & C. Wolff (Eds.), , Proceedings of the 14th International Symposium on Information Science (ISI 2015), (pp. 424-436). Verlag Werner Hülsbusch., , Monopolies on social network services (SNS) markets and competition law. In F. Pehar, C. Schlögl, & C. Wolff (Eds.), Proceedings of the 14th International Symposium on Information Science (ISI 2015), 2015, May 19-21, Verlag Werner Hülsbusch, 424, 436

Eighteenth EDPB plenary session. (European Data Protection Board) ((2020), Retrieved September 14, 2020) European Data Protection Board. (2020). Eighteenth EDPB plenary session. Retrieved September 14, 2020 from https://edpb.europa.eu/news/news/2020/eighteenth-edpbplenary-session_en. , from https://edpb.europa.eu/news/news/2020/eighteenth-edpbplenary-session_en

, Fietkiewicz, K. J., Dorsch, I., Scheibe, K., Zimmer, F., Stock, W. G. (2018, July 15-20). Dreaming of stardom and money: Micro-celebrities and influencers on live streaming services. In G. Meiselwitz (Ed.), , SCSM 2018: Social computing and social media. User experience and behavior, (pp. 240-253). Springer., , Dreaming of stardom and money: Micro-celebrities and influencers on live streaming services. In G. Meiselwitz (Ed.), SCSM 2018: Social computing and social media. User experience and behavior, 2018, July 15-20, Springer, 240, 253

, Fietkiewicz, K. J., & Ilhan, A. (2020, January 7-10). Fitness tracking technologies: Data privacy doesn’t matter? The (un)concerns of users, former users, and non-users. In T. X. Bui (Ed.), , Proceedings of the 53rd Hawaii International Conference on System Sciences, (pp. 3439-3448). HICSS (ScholarSpace)., , Fitness tracking technologies: Data privacy doesn’t matter? The (un)concerns of users, former users, and non-users. In T. X. Bui (Ed.), Proceedings of the 53rd Hawaii International Conference on System Sciences, 2020, January 7-10, HICSS, 3439, 3448

New media and new territories for European law: Competition in the market for social networking services. In K. Knautz, & K. Baran (Eds.), Facets of facebook: Use and users (, ) ((2016)) Berlin: De Gruyter Saur Fietkiewicz, K. J., & Lins, E. (2016). New media and new territories for European law: Competition in the market for social networking services. In K. Knautz, & K. Baran (Eds.), Facets of facebook: Use and users (pp. 285-324). Berlin: De Gruyter Saur. , pp. 285-324

Privacy changes everything. In V. Gadepally, T. Mattson, M. Stonebraker, F. Wang, G. Luo, Y. Laing, & A. Dubovitskaya (Eds.), Heterogeneous data management, polystores, and analytics for healthcare (, , , , , ) ((2019)) Springer Rogers, J., Bater, J., He, X., Machanavajjhala, A., Suresh, M., & Wang, X. (2019). Privacy changes everything. In V. Gadepally, T. Mattson, M. Stonebraker, F. Wang, G. Luo, Y. Laing, & A. Dubovitskaya (Eds.), Heterogeneous data management, polystores, and analytics for healthcare (pp. 96-111). Springer. , pp. 96-111

Microcelebrity and the branded self. In J. Hartley, J. E. Burgess, & A. Bruns (Eds.), A companion to new media dynamics () ((2013)) Hoboken: Blackwell Publishing Senft, T. M. (2013). Microcelebrity and the branded self. In J. Hartley, J. E. Burgess, & A. Bruns (Eds.), A companion to new media dynamics (pp. 346-354). Hoboken: Blackwell Publishing. , pp. 346-354

((2019)) Online behavioral advertising: An integrative review. Journal of Marketing Communications, https://doi.org/10.1080/13527266.2019.1630664 .

, Zhao, J., Ma, M., Gong, W., Zhang, L., Zhu, Y., & Liu, J. (2017, June 14-16). Social media stickiness in Mobile Personal Livestreaming service. In , IEEE/ACM 25th International Symposium on Quality of Service (IWQoS), (pp. 2). IEEE., , Social media stickiness in Mobile Personal Livestreaming service., In IEEE/ACM 25th International Symposium on Quality of Service (IWQoS), 2017, June 14-16, IEEE, 2

A model for information behavior research on social live streaming services (SLSSs). In G. Meiselwitz (Ed.), SCSM 2018: Social Computing and Social Media. Technologies and Analytics (, , ) ((2018)) Springer Zimmer, F., Scheibe, K., & Stock, W. G. (2018). A model for information behavior research on social live streaming services (SLSSs). In G. Meiselwitz (Ed.), SCSM 2018: Social Computing and Social Media. Technologies and Analytics (pp. 429-448). Springer. , pp. 429-448